4QFY2019 Result Update | Banking

May 25, 2019

ICICI Bank

BUY

CMP

`431

Performance Highlights

Target Price

`490

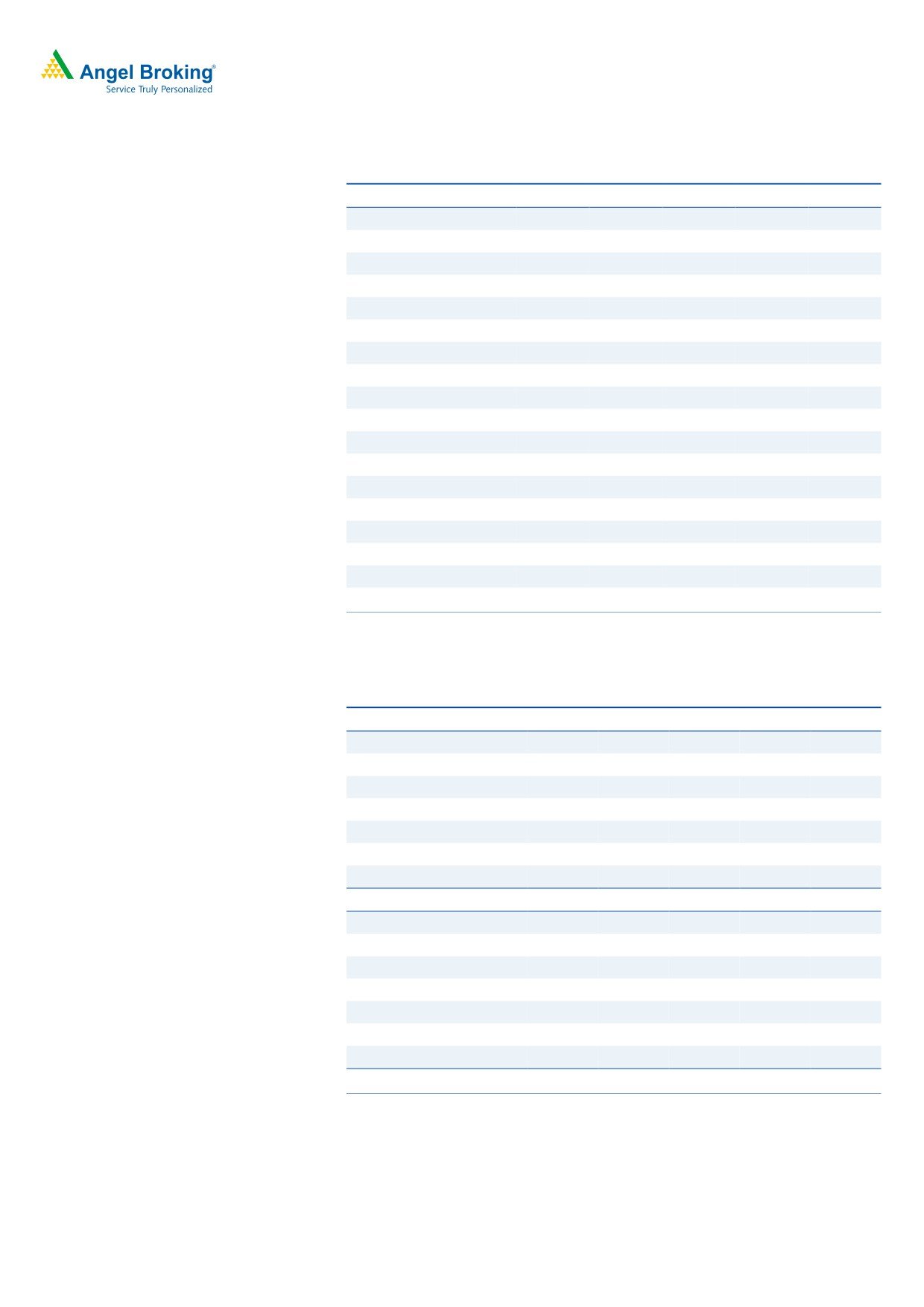

Particulars (` cr)

Q4FY19

Q3FY19

% chg (qoq) 4QFY18

% chg (yoy)

Investment Period

12 Months

NII

7,620

6,875

10.8

6,022

27

Pre-prov. profit

6,233

6,146

1.4

7,513

(17)

Stock Info

PAT

969

1,605

(39.6)

1,019

(5)

Sector

Banking

Source: Company, Angel Research

Market Cap (` cr)

2,64,789

For Q4FY2019, ICICI Bank reported net profit of `969cr, which came in lower

Beta

1.3

than estimates owing to higher provisions of `5,451cr. Higher provisions were due

52 Week High / Low

433/256

to aging of bad assets and increased slippages, which led to PCR increasing by

Avg. Daily Volume

11,24,581

217bps qoq to 70.62% (considering Technical/prudential write-offs, it stood at

Face Value (`)

2

76%).

BSE Sensex

39,434

Nifty

11,844

Healthy growth in retail advances; credit costs up on higher PCR: During

Reuters Code

ICBK.NS

Q4FY2019, the bank’s advances grew by 14.5% yoy (4% qoq) aided by healthy

Bloomberg Code

ICICIBC@IN

retail loan book growth of 21.2% yoy. The main drivers leading to the growth in

the retail loan book were personal loans/business banking, which grew by

48.6%/39.3% yoy respectively. Retail contribution to total loans increased to 60.1%

Shareholding Pattern (%)

vs. 57 in Q4FY2018.

Promoters

NA

Deposits growth was healthy at 16.4% yoy; CASA deposits also saw a growth of

MF / Banks / Indian Fls

31.7

11.7% yoy. Reported NIM for the quarter expanded 25bps/23bps qoq/yoy to

FII / NRIs / OCBs

60.4

3.47% owing to interest collection on NPAs and increase in advance yield.

Indian Public / Others

7.7

On the asset quality front, the bank witnessed slippages (fresh formation of NPA)

to the tune of `3,547cr during the quarter, which is higher than recent trend.

Majority of the slippages are from the portfolio rated BB & below and technical

Abs. (%)

3m 1yr

3yr

downgrade of sugar account. Further, GNPA/NNPA ratio declined by

Sensex

8.2

13.0

53.4

105bps/52bps qoq to 6.7%/2.06% respectively, due to higher provisioning.

ICICI Bank

16.7

40.8

101.3

Outlook & Valuation: At the current market price, the bank’s core banking

business (after adjusting the value of subsidiaries) is trading at 1.6x FY2021E ABV.

We believe strength of liability franchise (CASA - 50%), shift in loan mix towards

3-year price chart

retail assets & better rated companies, strong capitalization (tier I of

14.73%),

450

400

steady improvement in stressed loan and going forward quick resolution under

350

IBC would be the key triggers for expansion. We recommend a Buy on the stock

300

250

with a Target Price of `490.

200

150

Exhibit 1: Key Financials

Y/E March (` cr)

FY17

FY18

FY19

FY20E

FY21E

NII

21,738

23,025

27,015

31,749

37,524

Source: Company, Angel Research

% chg

2

6

17

18

18

Net profit

9,802

6,645

3,362

12,600

15,448

% chg

0.8

(32.2)

(49.4)

275

23

NIM (%)

3.2

3.1

3.2

3.4

3.5

EPS (`)

15

10

5

20

24

P/E (x)

28

42

83

22

18

Jaikishan Parmar

P/ABV (x)

4

3

3

3

2

Research Analyst

RoA (%)

1.3

0.8

0.4

1.2

1.3

022 - 39357600 Ext: 6810

RoE (%)

10

6

3

11

12

Source: Company

Please refer to important disclosures at the end of this report

1

ICICI Bank | 4QFY2019 Result Update

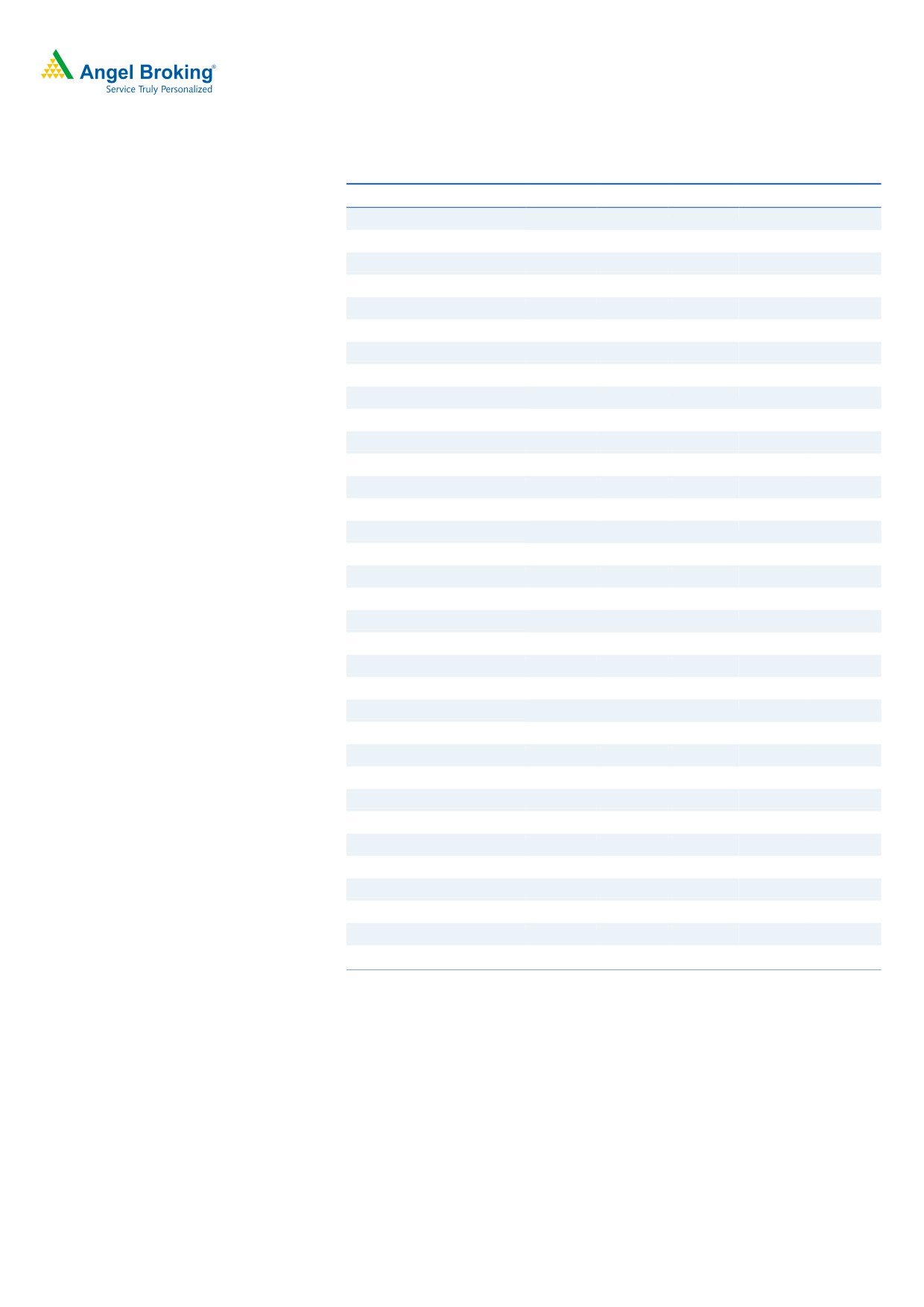

Exhibit 1: Quarterly Summary

Particular (` cr)

Q1FY18

Q2FY18

Q3FY18

Q4FY18

Q1FY19

Q2FY19

Q3FY19

Q4FY19

YOY

QoQ

Interest Income

13,459

13,577

13,665

14,264

14,722

15,106

16,280

17,293

21

6

Interest Expenses

7,869

7,868

7,960

8,243

8,620

8,688

9,405

9,673

17

3

Net Interest Income (NII)

5,590

5,709

5,705

6,022

6,102

6,418

6,875

7,620

27

11

Other Income

3,388

5,186

3,167

5,678

3,851

3,156

3,883

3,621

(36)

(7)

Fee Income

2,377

2,570

2,639

2,755

2,754

2,995

3,062

3,178

15

4

Total Income

16,847

18,763

16,832

19,942

18,573

18,262

20,163

20,914

5

4

Net Income

8,978

10,895

8,872

11,700

9,953

9,574

10,758

11,241

(4)

4

Operating Expenses

3,794

3,909

3,814

4,186

4,145

4,324

4,612

5,008

20

9

Employee Expenses

1,511

1,514

1,363

1,526

1,514

1,661

1,734

1,899

24

10

Other Operating Expenses

2,283

2,395

2,452

2,660

2,631

2,663

2,878

3,109

17

8

Cost / Income %

42%

36%

43%

36%

42%

45%

43%

45%

290

168

Operating Profit

5,184

6,986

5,057

7,513

5,808

5,250

6,146

6,233

(17)

1

Provisions

2,609

4,503

3,570

6,626

5,971

3,994

4,244

5,451

(18)

28

PBT

2,575

2,483

1,488

888

(164)

1,255

1,902

782

(12)

(59)

Provisions for Tax

526

425

(162)

(132)

(43)

347

297

(187)

42

(163)

Tax Rate %

20%

17%

-11%

12%

23%

23%

23%

23%

-

PAT

2,050

2,058

1,650

1,019

(120)

909

1,605

969

(5)

(40)

Source: Company, Angel Research, % changes are on bps

Exhibit 2: Advance Trend and Profitability

Particular (` cr)

Q1FY18

Q2FY18

Q3FY18

Q4FY18

Q1FY19

Q2FY19

Q3FY19

Q4FY19

YOY

QoQ

Advances

4,64,075

4,82,780

5,05,387

5,12,395

5,16,289

5,44,487

5,64,308

5,86,647

14.5

4

Deposits

4,86,254

4,98,643

5,17,403

5,60,975

5,46,878

5,58,669

6,06,755

6,52,920

16.4

8

Savings

1,69,950

1,78,480

1,85,851

2,00,967

1,99,604

2,07,476

2,10,793

2,27,671

13.3

8

Current

68,073

68,396

74,784

88,958

76,689

76,072

88,581

96,269

8.2

9

CASA

2,38,023

2,46,876

2,60,635

2,89,925

2,76,293

2,83,548

2,99,374

3,23,940

11.7

8

CASA%

48.95

49.51

50.37

51.68

50.52

50.75

49.34

49.61

(206.8)

27.4

SA%

71.40

72.30

71.31

69.32

72.24

73.17

70.41

70.28

96.5

(12.9)

CA%

28.60

27.70

28.69

30.68

27.76

26.83

29.59

29.72

(96.5)

12.9

Term

2,48,231

2,51,767

2,56,768

2,71,050

2,70,585

2,75,121

3,07,381

3,28,980

21.4

7

Borrowings

1,41,460

1,50,702

1,58,176

1,82,859

1,61,970

1,74,686

1,64,293

1,65,320

(9.6)

1

Profitability

Yield Advance

8.49

8.53

8.29

8.40

8.54

8.68

9.04

8.98

58

(5)

Cost of Fund

4.81

4.93

4.75

4.49

4.54

4.78

4.62

4.73

25

11

Spread

3.68

3.60

3.54

3.92

4.00

3.90

4.42

4.25

33

(17)

Calculated NIM

3.35

3.38

3.27

3.27

3.25

3.44

3.55

3.74

47

19

Reported NIM

3.27

3.27

3.14

3.24

3.19

3.33

3.22

3.47

23

25

Source: Company, Angel Research, % changes are on bps

May 25, 2019

2

ICICI Bank | 4QFY2019 Result Update

Exhibit 3: GNPA Movement

Particular (` cr)

Q1FY18 Q2FY18 Q3FY18 Q4FY18 Q1FY19 Q2FY19 Q3FY19 Q4FY19

YOY

QoQ

Opening gross NPA

42,552

43,148

44,489

46,039

54,063

53,465

54,489

51,627

12.1

(5)

Add: gross additions

4,976

4,674

4,380

15,737

4,036

3,117

2,091

3,547

(77.5)

70

slippages

1.07%

0.97%

0.87%

3.07%

0.78%

0.57%

0.37%

0.60%

(247)

23

Slippages Annulised

3.87%

3.47%

12.29%

3.13%

2.29%

1.48%

2.42%

(987)

94

Less: recoveries & upgrades

2,775

1,029

1,108

4,234

2,036

1,006

1,916

1,522

(64.1)

(21)

% of Adv recoveries & upgrades

0.60%

0.21%

0.22%

0.83%

0.39%

0.18%

0.34%

0.26%

(57)

(8)

Net additions

2,201

3,645

3,272

11,503

2,000

2,111

175

2,025

(82.4)

1,057

Less: write-offs & sale

1,605

2,304

1,722

3,479

2,598

1,087

3,037

7,324

110.5

141

% of Adv recoveries & upgrades

0.35%

0.48%

0.34%

0.68%

0.50%

0.20%

0.54%

1.25%

57

71

Closing gross NPAs

43,148

44,489

46,039

54,063

53,465

54,489

51,627

46,328

(14.3)

(10)

GNPA

8.0%

7.87%

7.82%

8.84%

8.81%

8.54%

7.75%

6.70%

(214)

(105)

Less - Provision

17,842

20,359

22,229

26,177

29,295

32,403

35,339

32,715

25.0

(7)

Net NPAs

25,306

24,130

23,810

27,886

24,170

22,086

16,288

13,613

(51.2)

(16)

NPA

4.86%

4.43%

4.20%

4.77%

4.19%

3.65%

2.58%

2.06%

(271)

(52)

PCR

41.35%

45.76%

48.28%

48.42%

54.79%

59.47%

68.45%

70.62%

2,220

217

Source: Company, Angel Research, % changes are on bps

Exhibit 4: Advance Mix (%)

Particular

Q1FY18

Q2FY18

Q3FY18

Q4FY18

Q1FY19

Q2FY19

Q3FY19

Q4FY19

YOY

QoQ

Retail

53

54

54

57

57.5

57.5

57.5

60.1

334

264

Corporate

27

27

27

26

25.4

25.4

25.4

23.9

(191)

(151)

International

15

15

14

13

12.5

12.5

12.5

10.7

(186)

(176)

SME

5

4

5

5

4.6

4.6

4.6

5.2

22

62

Total

100

100

100

100

100

100

100

100

(20)

(0)

Advance YoY Growth

Retail

18.6

18.9

22.4

21.0

20.0

20.5

21.6

21.2

20.2

(41.3)

Corporate

(12.1)

(6.4)

(2.8)

(2.3)

(0.1)

2.0

(1.6)

3.3

561.7

491.7

International

(25.0)

(21.2)

(14.6)

(13.6)

(9.7)

(4.0)

(5.1)

(2.4)

1,125.0

270.5

Domestic

(2.6)

4.4

4.6

4.3

5.4

5.3

0.1

6.0

172.3

588.8

SME

16.2

6.3

17.7

15.0

13.7

21.8

12.2

19.5

450.1

726.3

Advance

3.3

6.3

10.5

10.4

11.3

12.8

11.7

14.5

411.6

283.3

Source: Company, Angel Research, % changes are on bps

May 25, 2019

3

ICICI Bank | 4QFY2019 Result Update

Exhibit 5: SOTP Summary

Valuation

Value/share

Particular

%

Methodology

(`)

Value of ICICI standalone

100

2x FY21E ABV

384

Subsidiaries

ICICI Prudential Life

54.9

On Current M.Cap

44

General Insurance

56

On Current M.Cap

45

ICICI Pru AMC

51

5% of current AUM

14

Other (Home Fin, VC, Securities PD and

26

Overseas subsidiaries)

Total subsidiaries' value @ 20% discount

103

Fair value per share

487

Outlook & Valuation: At the current market price, the bank’s core banking

business (after adjusting the value of subsidiaries) is trading at 1.6x FY2021E

ABV. We believe strength of liability franchise (CASA - 50%), shift in loan mix

towards retail assets & better rated companies, strong capitalization (tier I of

14.73%), steady improvement in stressed loan and going forward quick

resolution under IBC would be the key triggers for expansion. We recommend

a Buy on the stock with a Target Price of `490.

May 25, 2019

4

ICICI Bank | 4QFY2019 Result Update

Income Statement

Y/E March (` cr)

FY17

FY18

FY19

FY20E

FY21E

Net Interest Income

21,738

23,025

27,015

31,749

37,524

- YoY Growth (%)

2

6

17

18

18

Other Income

19,503

17,419

14,511

15,861

18,752

- YoY Growth (%)

27

(11)

-17

9

18

Operating Income

41,241

40,444

41,526

47,610

56,275

- YoY Growth (%)

13

(2)

3

15

18

Operating Expenses

14,754

15,704

18,089

20,739

23,959

- YoY Growth (%)

16

6

15

15

16

Pre - Provision Profit

26,487

24,741

23,437

26,870

32,317

- YoY Growth (%)

11

(7)

-5

15

20

Prov. & Cont.

15,207

17,307

19,661

10,070

11,720

- YoY Growth (%)

30

14

14

(49)

16

Profit Before Tax

11,279

7,434

3,776

16,800

20,597

- YoY Growth (%)

(8)

(34)

-49

345

23

Prov. for Taxation

1,478

789

413

4,200

5,149

- as a % of PBT

13

11

11

25

25

PAT

9,802

6,645

3,362

12,600

15,448

- YoY Growth (%)

1

(32)

(49.4)

275

23

Balance Sheet

Y/E March (` cr)

FY17

FY18

FY19

FY20E

FY21E

Equity

1,171

1,292

1,294

1,295

1,295

Reserve & Surplus

98,780

1,03,868

1,07,074

1,17,154

1,29,512

Net worth

99,951

1,05,160

1,08,368

1,18,449

1,30,807

Deposits

4,90,039

5,60,975

6,52,920

7,49,240

8,59,771

- Growth (%)

16

14

16

15

15

Borrowings

1,47,556

1,82,859

1,65,320

1,88,611

2,20,648

Other Liab. & Prov.

34,245

30,195

37,851

44,620

69,769

Total Liabilities

7,71,791

8,79,189

9,64,459

11,00,921

12,80,995

Cash Balances

31,702

33,102

37,858

44,274

50,805

Bank Balances

44,011

51,067

42,438

33,882

38,881

Investments

1,61,507

2,02,994

2,07,733

2,41,287

2,79,437

Advances

4,64,232

5,12,395

5,86,647

6,76,443

7,91,342

- Growth (%)

7

10

14

15

17

Fixed Assets

7,805

7,904

7,931

11,491

13,186

Other Assets

62,535

71,727

81,852

93,545

1,07,345

Total Assets

7,71,791

8,79,189

9,64,459

11,00,921

12,80,995

May 25, 2019

5

ICICI Bank | 4QFY2019 Result Update

Exhibit 6: Key Ratio

Y/E March

FY17

FY18

FY19

FY20E

FY21E

Profitability ratios (%)

NIMs

3.2

3.1

3.2

3.4

3.5

Cost to Income Ratio

36

39

44

44

43

RoA

1.3

0.8

0.4

1.2

1.3

RoE

10

6

3

11

12

B/S ratios (%)

CASA Ratio

50

52

50

51

51

Credit/Deposit Ratio

0.95

0.91

0.90

0.90

0.92

Asset Quality (%)

Gross NPAs

7.9

8.8

6.7

5.1

3.7

Net NPAs

4.9

3.5

2.7

2.0

1.5

Slippages

7.5

6.4

2.5

2.0

1.5

Loan Loss Prov. /Avg. Assets

2.04

2.10

2.13

0.98

0.98

Provision Coverage

40

48

71

70

70

Per Share Data (`)

EPS

15

10

5

20

24

ABVPS (70% cover.)

119

129

153

169

188

DPS

2

2

1

4

5

Valuation Ratios

PER (x)

28

42

83

22

18

P/ABVPS (x)

3.6

3.3

2.8

2.6

2.3

Dividend Yield (%)

0.5

0.5

0.2

0.9

1.1

DuPont Analysis

NII

2.9

2.8

2.9

3.1

3.2

(-) Prov. Exp.

2.0

2.1

2.1

1.0

1.0

Adj. NII

0.9

0.7

0.8

2.1

2.2

Other Inc.

2.6

2.1

1.6

1.5

1.6

Op. Inc.

3.5

2.8

2.4

3.6

3.7

Opex

2.0

1.9

2.0

2.0

2.0

PBT

1.5

0.9

0.4

1.6

1.7

Taxes

0.2

0.1

0.0

0.4

0.4

RoA

1.3

0.8

0.4

1.2

1.3

Leverage

7.9

8.0

8.6

9.1

9.6

RoE

10.3

6.5

3.1

11.1

12.4

Source: Valuation done on Closing price of 24/5/2019

May 25, 2019

6

ICICI Bank | 4QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

ICICI Bank

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

May 25, 2019

7

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)